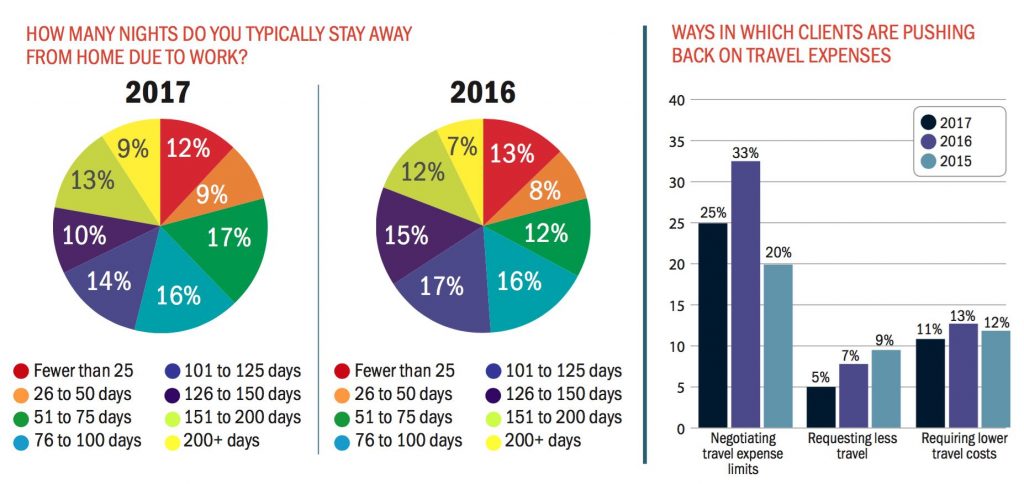

With the economy continuing to hum along and consulting pipelines still strong, consultants—for the first time in a few years—are traveling less. And when they do travel, their trips are a little shorter than they've previously been, according to Consulting magazine's annual Best Places to Stay survey, which was conducted between April and July. This year, 193 consultants participated in the survey, reporting their travel habits and road-warrior preferences over the last 12 months.

Last year, 51 percent of consultants reported they spent more than 100 days a year on the road, but that number dipped to 46 percent this year, which is the lowest it's been since the great recession nearly a decade ago. For the purposes of measuring travel, the 100-day threshold works out to about two or more days per week, which is considered to be the benchmark for achieving "road warrior" status in the profession.

To continue reading, become an ALM digital reader

Benefits include:

- Authoritative and broad coverage of the business of consulting

- Industry-leading awards programs like Best Firms to Work For, Global Leades and Rising Stars

- An informative newsletter that goes into the trends shaping the industry

- Critical coverage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now