The UK is undergoing a pensions revolution—one that started long before the recent general elections and will continue for some time to come. There have been significant changes in pension legislation, modernizing rules and regulations to allow citizens greater freedoms in their retirement planning. Of particular note is the enacted change in April that allows over-55s the ability to take their savings from defined contribution plans and use them as they see fit without the need to purchase annuities, a previous requirement that gave security in regular interval income.

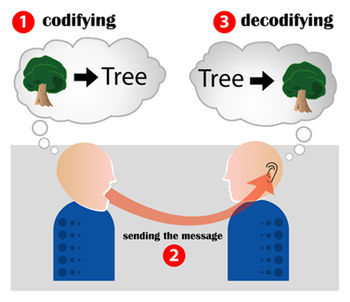

The freedom to take one's savings at their leisure certainly has advantages for those with the savvy to make the most of it, but the average consumer, however, will need assistance with this change of responsibility to ensure that they are using their funds wisely, and do not find their retirement wallets emptied out far too early. In order to do this, companies must double down on education for its employees to make informed decisions in a rapidly changing environment.

Enter the benefits consultants. As the UK revolutionizes its retirement benefits regulations, both the private and the public sector will increasingly need support in both understanding the impacts of the changes and how best to communicate them with their employees. Communications strategy, in particular, will be of value to clients. Employees are suddenly finding themselves with new freedoms in their retirement that they never had before. There are plenty of advantages that can be had under this new system, such as wisely pulling funding in smaller increments to relieve the tax liability that comes from withdrawing funds, but there is also no safety net in place to prevent employees from making potentially fatal mistakes with savings they will need to be dependent upon for many years. Examples include underestimating life expectancy, making uninformed investment choices, or withdrawing too many funds at once, incurring significant tax liability.